Thailand is set to buy an extra 1 million tonnes of liquefied natural gas (LNG) from the United States over the next five years, valued at about $500 million (16.6 billion baht). This step aims to help balance trade after the US imposed a steep tariff on Thai exports.

This announcement comes before trade talks scheduled with the US next week to address the tariff issue.

On Wednesday, Deputy Prime Minister and Finance Minister Pichai Chunhavajira met with leaders from PTT Plc, the country’s main oil and gas company, to discuss the 36% tariff the US has placed on Thai products.

Pichai explained that PTT will purchase 1 million tonnes of LNG from the US next year, which should ease some concerns in Washington.

He also noted that current LNG contracts with other countries will run out in the next five years. As a result, PTT plans to buy an extra 1 million tonnes of LNG per year from the US to cover future demand.

PTT is also looking at options to buy more LNG from the US and sell it to neighboring countries. To manage these larger imports, the company will need to invest in new storage facilities.

Pichai said the Thai team will confirm these LNG purchases in upcoming talks with the US, adding that these imports fit with PTT’s plans to support exports. If Thailand brings in more LNG than it needs, PTT is ready to ship the surplus to other countries.

The company already has several facilities in place to import and resell LNG. He believes natural gas will remain a main energy source worldwide for decades, leaving room for more LNG imports from the US in the future.

Thailand’s LNG Imports

Buying more LNG from the US could benefit both countries. Thailand already has a 15-year deal to buy 1 million tonnes of LNG annually from the US at a cost of $500 million.

The country imports more than 10 million tonnes of LNG each year, mainly from the Middle East. Gas provides about 60% of Thailand’s electricity. Importing more goods from the US, including LNG, should help lower Thailand’s trade surplus with America.

Thailand is also in talks to import 400,000 tonnes of ethane from the US over four years, worth $100 million. Last year, Thailand’s trade surplus with the US reached $45.6 billion.

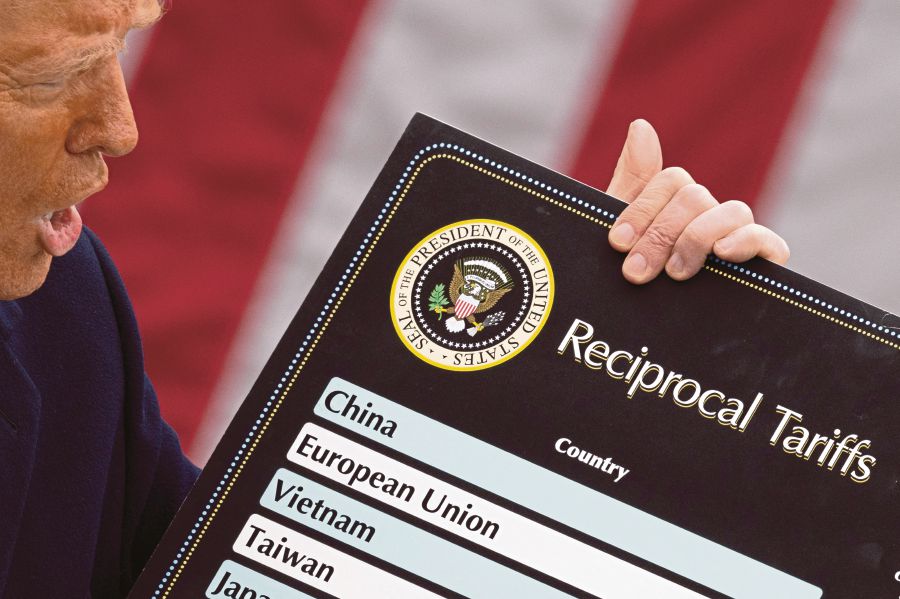

The 36% tariff on Thai products was scheduled to start on April 9. However, US President Donald Trump delayed it by 90 days, giving countries time to negotiate if they didn’t respond with their own tariffs.

Before leaving for the US, Pichai met with Bank of Thailand governor Sethaput Suthiwartnarueput to discuss what could be done about the tariffs. Afterward, Pichai said he and the central bank chief agreed there’s no clear way to respond yet.

The government needs to watch how US tariff policy plays out before taking action.

Trade Tension

At the same time, President Trump highlighted tariff negotiations with Japan while China accused the US of “blackmail” as trade tensions continue. The World Trade Organization has warned that these disputes could hurt the global economy.

Trump said he would meet Japanese officials to discuss tariffs, military costs, and trade fairness. He posted on Truth Social that he would join talks with Japan on tariffs and other trade issues.

Talks with Japan are running alongside the US trade dispute with China. China faces tariffs as high as 145% on some products, while the rest of the world faces a 10% duty. China has responded with its own high tariffs on US goods.

China’s Foreign Ministry said the US should stop using threats and pressure, and instead talk on equal terms. The spokesperson said there are no winners in a trade war and stressed that China wants peace but isn’t afraid to defend its interests.

China’s commerce ministry pointed out that some Chinese goods now face a total tariff of 245% when entering the US.

Despite concerns about the trade war’s effect on the US economy, China reported 5.4% growth in the first quarter, as exporters rushed shipments before the tariffs took effect. Trump expressed hope that a positive deal could be reached with Japan, and Japan’s envoy also sounded optimistic.

In South Korea, Finance Minister Choi Sang-mok will meet US Treasury Secretary Scott Bessent next week. Choi said the main focus is to delay the tariffs and reduce uncertainty for Korean companies.

Stephen Innes from SPI Asset Management said the talks with Japan could set a pattern for other countries. If Japan gets a deal, others may follow. If not, more countries may brace for conflict.

The Daiwa Institute of Research warned that Trump’s tariffs could cut Japan’s real GDP by 1.8% by 2029.

Asian chip stocks dropped after Nvidia said it could lose $5.5 billion because of new US licensing rules that limit the chips it can sell to China.

Related News:

India and the U.S. Come Closer to a Win-Win Bilateral Trade Deal

Geoff Thomas is an award winning journalist known for his sharp insights and no-nonsense reporting style. Over the years he has worked for Reuters and the Canadian Press covering everything from political scandals to human interest stories. He brings a clear and direct approach to his work.