Lampang – Police have arrested two women for running an elaborate car pawn scam across northern Thailand. Their operation, which tricked people into pawning cars before selling them off and continuing to collect payments, has left a trail of 24 cases in several provinces.

On Monday, police leaders in Lampang announced the arrest of Ms Ing and Ms Oil (last names Witheald) after car pawn victims from multiple northern provinces had reported losing their vehicles and money.

The two women pretended to run a car pawn service, targeting people in financial trouble. They offered a cash advance for cars, took possession, then removed tracking devices before selling the vehicles on.

While the original owners kept making monthly payments, they no longer had their cars. When someone tried to settle the debt to get their car back, the woman accepted the payoff, promised to return the car, then disappeared with the money.

Some victims were even left stranded at petrol stations or roadside locations after being told they’d be reunited with their vehicles.

The scam didn’t stop there. Ing and Oil also sold these pawned cars at low prices. When new buyers drove away with what they thought was a bargain, the gang followed them. At the right time, they’d block the car, claim it as their own, and drive off—sometimes using spare keys.

This operation has caused losses worth millions of baht to people across Lampang, Chiang Mai, Lamphun, and Phrae. Police have charged the two women with embezzlement and being part of a criminal group.

Authorities are urging anyone else caught up in the scam to come forward and file a report at the Lampang police station.

Ing faces 19 cases, while Oil has 5 counts of embezzlement and fraud. Both have ongoing court and police investigations as efforts continue to track down other members of their network.

Car Pawn in Thailand Explained

Pawning a car in Thailand involves using your vehicle as collateral for a short-term loan from a pawn shop or specialised auto pawn service.

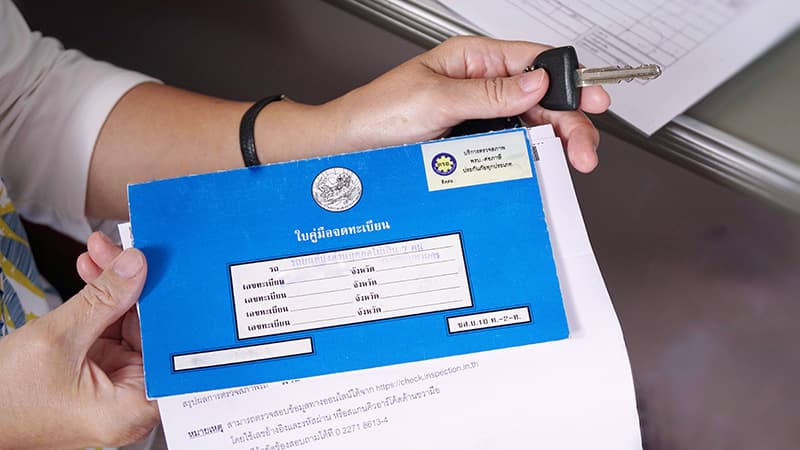

You bring your car to a pawn shop or auto pawn service, along with necessary documents (e.g., vehicle registration, ID, and proof of ownership). The pawn shop appraises the car’s value and offers a loan based on a percentage of that value.

If you accept, you receive cash and a loan agreement, while the pawn shop may keep the car or its registration book as collateral.

Loans are typically short-term, with repayment periods ranging from a few months to a year. Interest rates vary, but private pawn shops may charge high rates (e.g., 10% per month in some cases), while government-run pawn shops offer lower rates (e.g., 0.10–1.5% per month).

You repay the loan plus interest within the agreed period to retrieve your car or documents. If you default, the pawn shop can sell the vehicle to recover the loan amount. Some shops may require storage fees or force ownership transfer agreements for nonpayment.

Buying a car “out of pawn” is risky due to potential legal issues, such as unclear ownership or stolen vehicles. Without a blue book, transferring ownership is nearly impossible, and buyers may face legal consequences.

Related News:

Bank of Thailand Under Pressure to Drop Prime Lending Rate

Geoff Thomas is an award winning journalist known for his sharp insights and no-nonsense reporting style. Over the years he has worked for Reuters and the Canadian Press covering everything from political scandals to human interest stories. He brings a clear and direct approach to his work.