Milieu Insight, a market research and data analytics firm, released survey results pointing to heightened anxiety among Southeast Asians over recently announced U.S. tariffs on goods from the region. The report highlights growing worries about rising prices and economic challenges, with many already adjusting their purchasing habits.

The survey polled 6,043 people across Indonesia, Malaysia, Thailand, Singapore, the Philippines, and Vietnam. Respondents represented the online population in these countries.

Breakdown of U.S. Tariff Increases

The newly introduced tariffs will significantly impact exports from several Southeast Asian nations:

- 46% tariff on Vietnam’s exports

- 36% on Thailand’s goods

- 32% on products from Indonesia

- 24% on Malaysia’s exports

- 17% on goods from the Philippines

- 10% on Singapore’s exports

“These numbers illustrate that Southeast Asians are bracing for economic shifts caused by these tariffs,” said Gerald Ang, Founder and COO of Milieu Insight. “Higher prices are a likely outcome, pushing people in the region to modify their spending and prioritize locally made products. This change could have long-term effects on consumption trends and the broader economy.”

Regional Concerns About Daily Impact

The survey found that 73% of respondents were aware of the tariffs, reflecting widespread attention across the region. Concerns about how the tariffs might affect everyday life were especially high in Vietnam (78%), Thailand (75%), Indonesia (73%), and Singapore (72%). While Malaysians were less concerned compared to their neighbors, 63% still expressed worry.

When asked about potential national impacts, 93% of Thai respondents believed the tariffs would harm their country, the highest level of apprehension in the region. Meanwhile, 90% of Southeast Asians predicted the tariffs would drive up the cost of daily essentials.

Spending Shifts and Local Alternatives

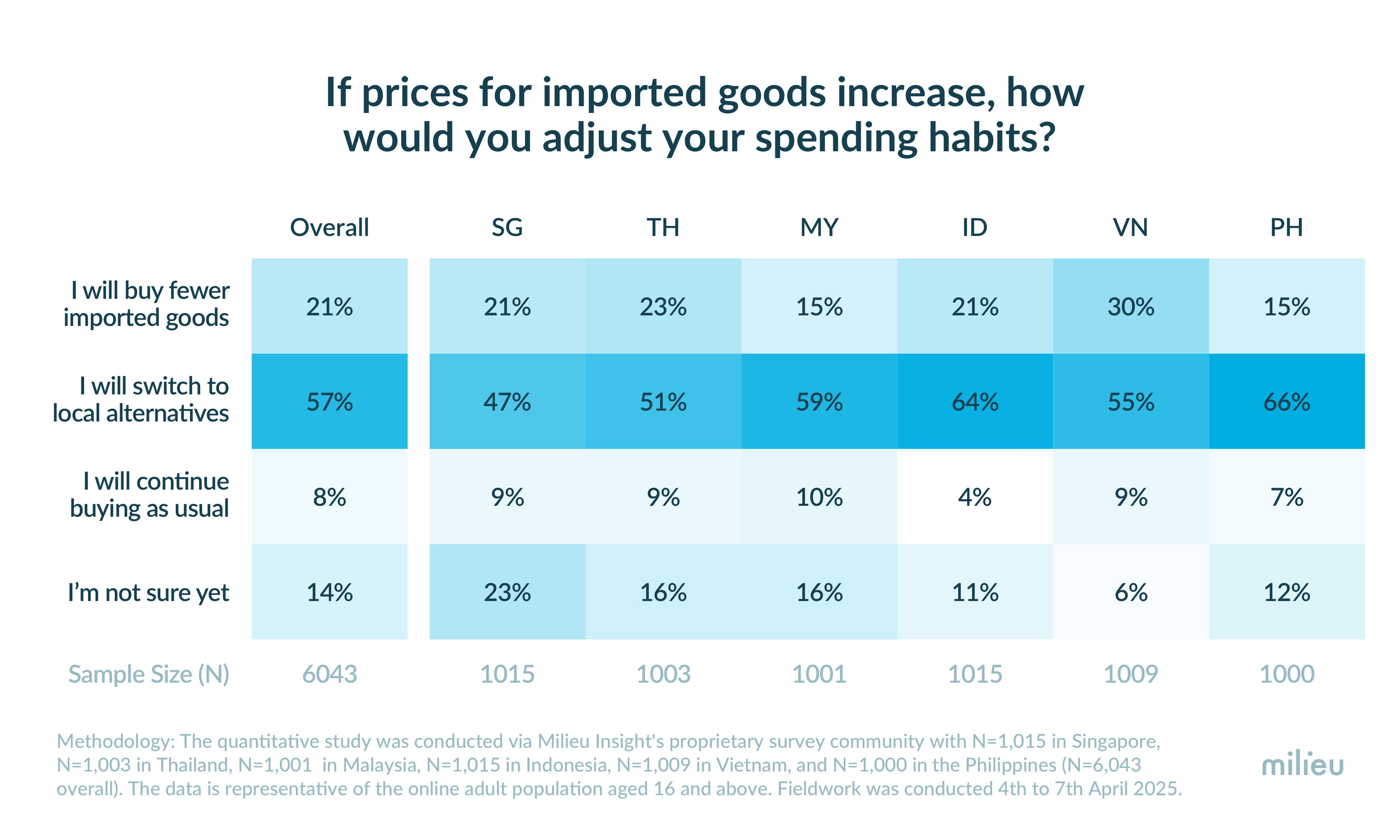

Rising concerns are already influencing purchasing behavior. Many respondents indicated a stronger preference for local goods over imports.

- 87% of those who typically favor international brands said they are now more likely to buy local products.

- About 75% said they plan to cut back on imported goods or switch to locally made alternatives.

Electronics and gadgets emerged as the most vulnerable category to price hikes. In Singapore, 73% of respondents viewed these items as most affected, followed by automobiles (55%) and household appliances (53%). Similar trends were reported in other countries, with 63% identifying electronics as the most likely to see price increases.

Who Will Bear the Costs?

Expectations about who will absorb the added costs differ by country.

- In Singapore, 59% of respondents expect businesses to pass on the costs to consumers.

- The same sentiment was shared by 51% of Filipinos and 37% of Malaysians.

- On the other hand, 49% of Thais and 48% of Vietnamese believe businesses will offer discounts or promotions to offset price increases.

Public Confidence in Government Response

Confidence in government action varies across the region. Vietnam (81%) and Singapore (66%) showed the highest trust in their governments’ ability to manage the fallout. In contrast, most people in Thailand (68%) and the Philippines (61%) expressed doubts about their governments’ effectiveness.

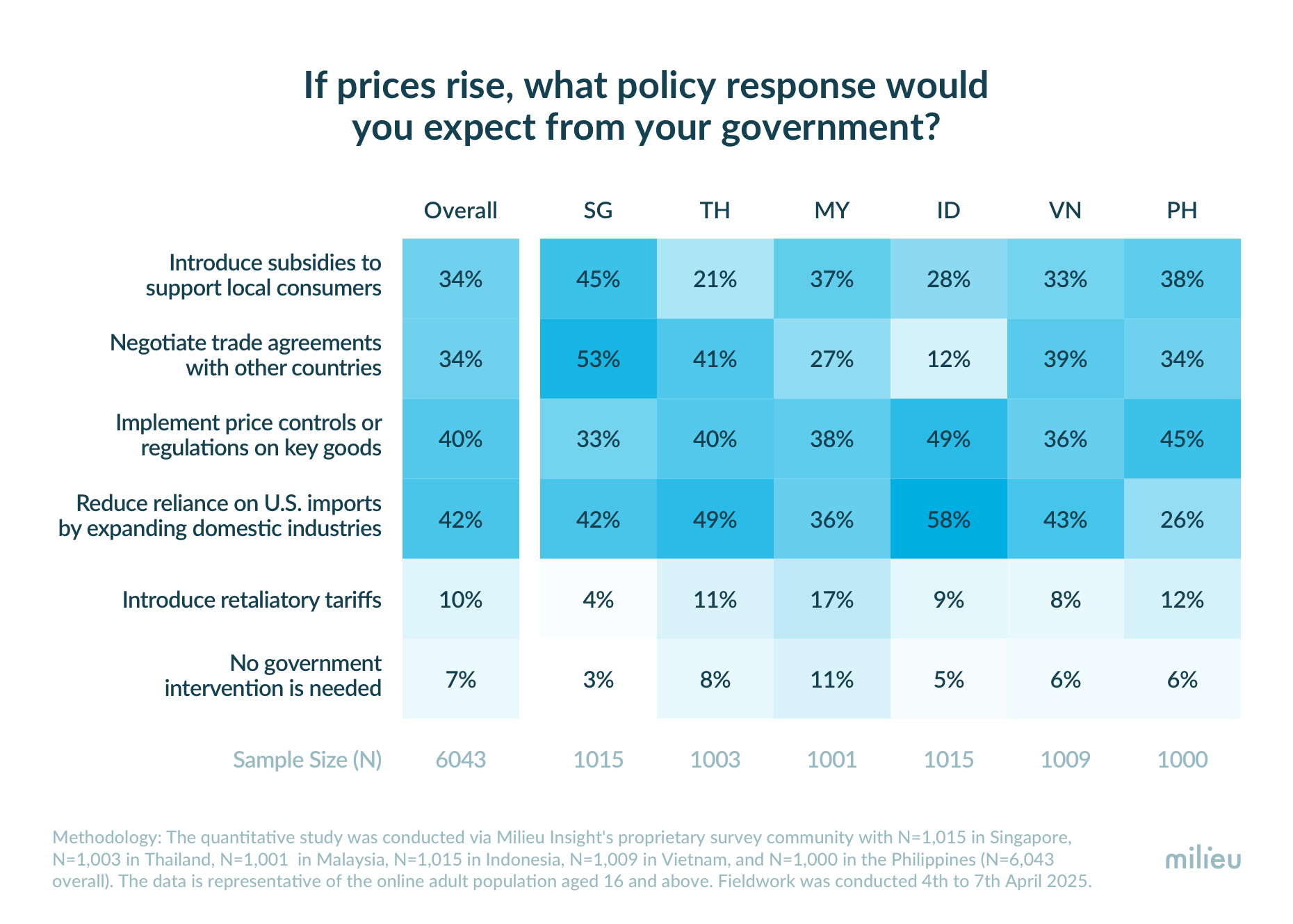

Looking ahead, 42% of respondents said they hope to reduce reliance on U.S. imports by strengthening local industries. Another 40% suggested price controls or regulations on essential goods, while 34% called for subsidies to support consumers and trade negotiations with other countries.

Related News:

Trump’s Tariffs are Causing Apple to Airlift 1.5 Million iPhones from India.

Geoff Thomas is an award winning journalist known for his sharp insights and no-nonsense reporting style. Over the years he has worked for Reuters and the Canadian Press covering everything from political scandals to human interest stories. He brings a clear and direct approach to his work.