(CTN News) – Amid a severe drought, Thailand is suffering from record heat, which is making it more difficult to harvest sugar cane. Since the nation produces 5% of the world’s output, the effects can reduce supply and raise prices. Barchart said, “Decreased sugar production in Thailand is bullish for sugar prices.”

“Thailand’s rainfall during this time of the previous year was less. Furthermore, Thailand’s rainfall may continue to be low due to the ongoing El Nino weather phenomenon. This is the lowest crushed cane output in at least 13 years, according to sugar millers in Thailand.

Thailand is turning to artificial techniques to produce rain in response to the country’s extreme heatwave. This includes, as Bloomberg earlier this year reported, sending planes equipped with cloud-seeding capabilities to create rain.

Although this has had an impact on the nation’s exports, more tourists are heading outside this summer as the post-pandemic recovery continues, which has boosted Thailand’s economy. Nonetheless, the nation’s economy still depends heavily on its capacity to grow sugar cane.

According to a Bangkok Post report published in April, Verasak Kwanmuang, a farmer’s representative on the Office of the Cane and Sugar Board (OCSB), said, “Our sugar cane harvests fell by 11.7 million metric tonnes, down from 93.9 million metric tonnes in the 2022–23 crop year.”

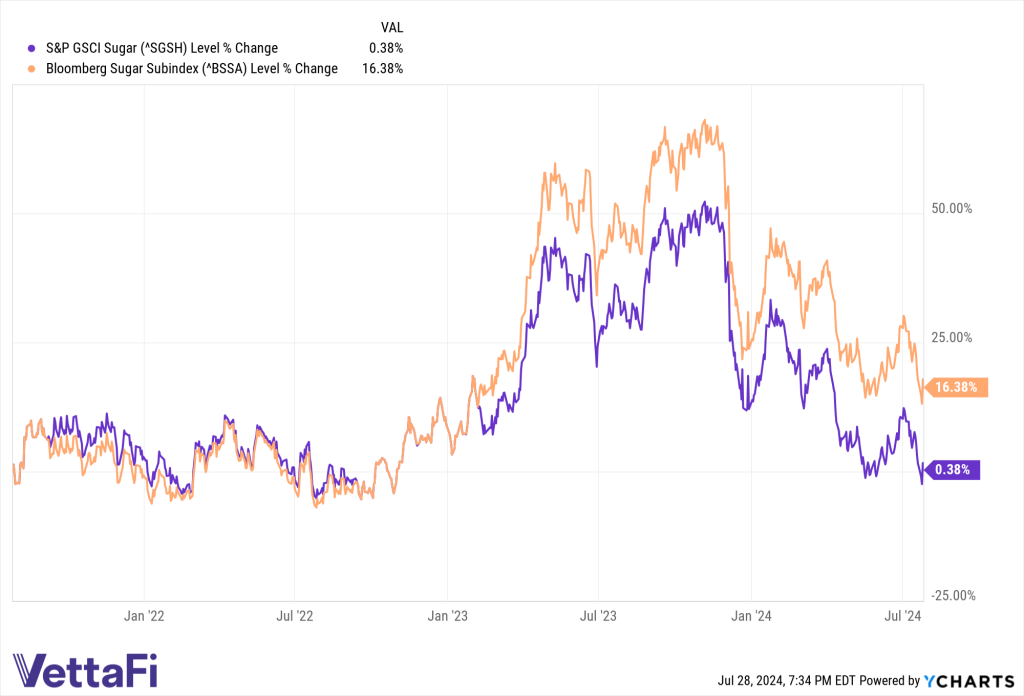

The price of sugar has decreased since it peaked in late 2023. The holidays were an especially bad time for consumers. Buying candy and other sweet delicacies at such a time usually increases demand. The S&P GSCI Sugar index is only up 0.38% over three years, but the Bloomberg Sugar Subindex is up slightly more than 16%.

India’s consumption will boost sugar prices

The drought in Thailand increases the strain to satisfy demand from other nations, such as India. That latter nation is poised for record consumption. According to the Business Standard, India’s consumption will continue its upward trajectory over the following year.

“The country’s net sugar consumption might touch an unprecedented 30 million tonnes in the next 2024–25 season (October to September) on the back of a steady 2.2 percent year-on-year growth rate, market participants said,” according to Business Standard.

Sugar prices have fallen, providing investors with an opportunity to get sugar exposure at a low cost. Funds such as the Teucrium Sugar ETF (CANE) may provide portfolio diversity by offering exposure to agricultural commodities such as sugar, typically via futures contracts.

Source: Etftrends

Anna Wong serves as the editor of the Chiang Rai Times, bringing precision and clarity to the publication. Her leadership ensures that the news reaches readers with accuracy and insight. With a keen eye for detail,